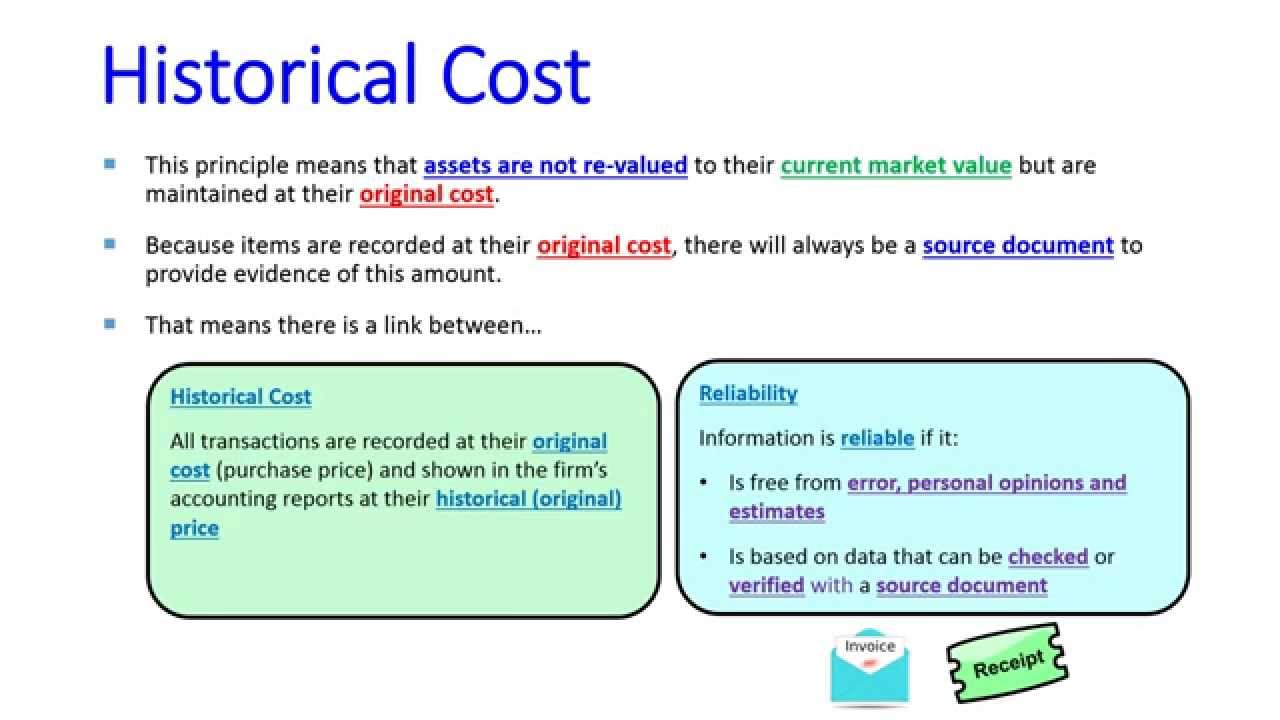

This means that the costs of a revenue-generating activity are reported when the item is sold rather than when the organization receives payment or issues an invoice for it. Revenues and expenses are matched using the matching GAAP principle which is the second of the four main principles of GAAP. will report $100,000 in revenue regardless of payment receipt status. The contract was completed with a service charge of $100,000 as agreed upon. provided window cleaning services to all of Hemingway Holdings’ estate buildings by the terms of their contract. Revenue recognition times can vary depending on whether the organization uses the cash or accrual accounting method, but the GAAP principle is that it will be recognized on time.įor example, The Matrix Inc. This is also referred to as accrual accounting. The revenue recognition principle dictates that all revenue must be reported when it is realized and earned, not when cash is received, according to the “revenue” principle. Despite the asset’s increasing value, the company would report the original cost of $750,000 on its financial statements. The plot of land is expected to be worth $1,000,000 by 2025. All values listed and reported, in the “cost” principle, are the costs of obtaining or acquiring the asset, not the fair market value.įor example, Alexia LTD plans to buy a plot of land for $750,000 in 2023 to use as a manufacturing factory site.

According to the cost principle of GAAP, the cost must be reported at its purchase value and not the currently updated time value. The cost principle asserts that all listed values are correct and reflect only actual costs, not the market value of the cost items. The four major principles are primarily used by accounting professionals who prepare public earnings statements and financial reports, to provide some level of consistency throughout major industries. The specifics of the principles vary slightly by jurisdiction, in the majority of scenarios, they encompass assumptions, basic principles, and basic constraints. GAAP is a set of rules and guidelines that assist businesses in preparing financial statements. While GAAP is not required for all organizations, you may want to consider using these principles when preparing your financial statements. With GAAP, presenting a company’s finances to outside entities (such as banks) becomes easier and more manageable. GAAP assists small business owners and accounting professionals in tracking a company’s finances.

GAAP standardizes the way businesses prepare financial statements and perform accounting tasks. The goal of GAAP is to ensure that financial reporting is consistent and transparent from one organization to the next. The GAAP specifications, which are the standard adopted by the Securities and Exchange Commission (SEC), include definitions of concepts and principles and industry-specific rules. GAAP, also known as US GAAP, is a set of commonly followed accounting rules and standards for financial reporting.

GAAP varies by country, and there is no universally recognized financial reporting, logging, and posting system in place at the moment. It debated and implemented four major rules and standards. In the early 1970s, the Financial Accounting Standards Board (FASB) and the Governmental Accounting Standards Board (GASB) in the United States developed and implemented GAAP. History of The Four Main Principles of GAAP

0 kommentar(er)

0 kommentar(er)